U.S. stocks finished Friday on a mixed note, capping off a turbulent week marked by sharp sector swings, shifting geopolitical headlines, and fresh weather-related risks. The S&P 500 finished Friday nearly flat but logged its second consecutive weekly loss amid volatile trading, underscoring how fragile investor sentiment remains despite periodic rallies.

The tech-heavy Nasdaq Composite outperformed, extending its advance as easing geopolitical concerns encouraged selective risk-taking. By contrast, the Dow Jones Industrial Average lagged, dragged lower by weakness in financials. The Dow slid 285.30 points, or 0.58%, to close at 49,098.71, while the Nasdaq rose 0.28% to 23,501.24. The broad-based S&P 500 edged up just 0.03% to finish at 6,915.61.

Losses in Goldman Sachs weighed heavily on the Dow, with the stock falling nearly 4%. Meanwhile, large-cap chipmakers helped stabilize the market. Nvidia gained about 1.5%, while Advanced Micro Devices climbed more than 2%, lending support to both the Nasdaq and the S&P 500. Sentiment around Nvidia improved after reports suggested CEO Jensen Huang is planning a visit to China in the coming days. Other technology heavyweights, including Microsoft, also moved higher.

Not all chip stocks shared in the rally. Intel plunged roughly 17% after issuing a weaker-than-expected first-quarter outlook, reminding investors that earnings risks remain elevated beneath the surface.

Trade Headlines Spark Short-Lived Relief

Markets had shown stronger momentum earlier in the week. All three major averages rallied for a second straight session on Thursday as investors reacted positively to signs of easing trade tensions and reduced geopolitical risk. The rebound began on Wednesday after U.S. President Donald Trump backed away from proposed tariffs on imports from eight European countries that were set to take effect on February 1.

Trump also said he and Mark Rutte had reached what he described as a “framework of a future deal” concerning Greenland. Earlier tariff threats had briefly triggered a pullback from U.S. assets, reviving talk of a “sell America” trade during the holiday-shortened week.

Still, uncertainty lingered. Jens-Frederik Nielsen said he was unaware of the details of any such framework, stressing that any agreement must respect Greenland’s sovereignty and territorial integrity.

Scott Ellis, managing director of corporate credit at Penn Mutual Asset Management, noted that markets appear increasingly sensitive to shifts in political rhetoric. He said investors have embraced what some are calling the “TACO trade,” a view that aggressive policy language may ultimately be softened to secure deals.

Weekly Losses and Weather Risks Add Pressure

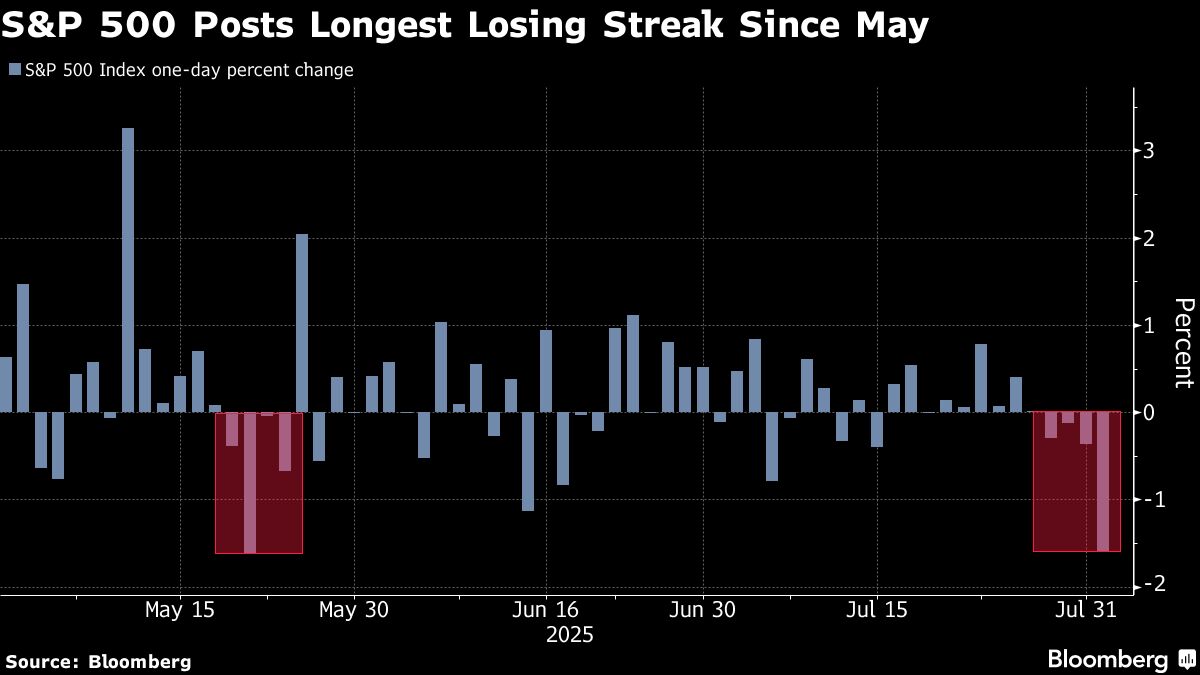

Despite midweek gains, Friday’s pullback pushed the Dow back into negative territory for the week. The Dow ended down about 0.5%, while the S&P 500 fell roughly 0.4%. The Nasdaq slipped less than 0.1%, but both the S&P 500 and Nasdaq recorded back-to-back weekly declines.

Beyond markets and politics, investors are also watching the weather. An Arctic storm moving across large parts of the U.S. could significantly disrupt natural gas supplies just as heating demand rises. Analysts at Goldman Sachs warned that freezing conditions could knock out more than 10% of U.S. natural gas production as wells are forced offline.

Forecasts from the National Weather Service show bitter cold across the Plains, Great Lakes, Mid-Atlantic, and Northeast, with heavy snow, ice, and freezing rain expected in multiple regions. Officials cautioned that the storm could lead to widespread power outages, dangerous travel conditions, and extensive damage — another unpredictable factor in an already unsettled market landscape.